Contributed by Carl Terzer, ICCIE Board Member and Instructor

The general purpose of an insurance company’s investment program is to take current earned premiums and invest them in a manner to assure its solvency when claims are to be paid out at various points in the future. Generally, this requires a more conservative approach to investing than most other institutional investors and is reflected as such in the regulatory restrictions placed on insurance investments. Of course, the types of insurance policies written have different liability durations, that is, expected payout patterns and periods. Over longer time periods, inflation, which has been muted for the last 10+ years at rates mostly below 3%, can have a big impact when expectations are for significantly higher inflation rates. Some investors can recall the rates of the late 1970’s and early 1980’s when annualized inflation roared at rates of nearly 14%. Insurer’s investment portfolios must reflect all these factors by using Asset Liability Management (ALM) techniques for their investment portfolios as well as practice sound enterprise risk management (ERM) to understand and correlate risks across the balance sheet.

Source: financetrainingcourse.com

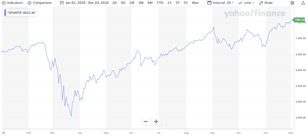

Looking at the 12 years since the great recession, through the end of 2020, we have witnessed an unusual time period for investing. We experienced the longest bull market cycle on record, albeit a rather plodding one, where buying the dip proved a nearly sure-fire strategy for investment success. Since the March 2020 crash, and continued high levels of volatility since, we have learned differently. We have been reminded that the equity markets are not only vulnerable to economic factors, such as leading indicators and general investor sentiment, but also to black swan events, such as the Covid19 pandemic, and the somewhat arbitrary and fickle sentiment of investors generating market momentum.

S&P 500 12-year Cumulative Return S&P 500 YTD- 2020 Cumulative Return

Source: Yahoo Finance

Notwithstanding the raised level of volatility, the US equity markets, as measured by the S&P 500, came roaring back to set new highs. Underlying equity market conditions actually were not as rosy as they seemed. The disproportionate influence of the FAANG +MSFT2 stocks drove the S&P 500 index to new records while, until recently, the vast majority of the large cap stocks posted negative or only slightly positive returns for the year.

2020 saw markets behave in an unusual manner; that of an unprecedented uncoupling of the US economy and the US equity market. Eventually, we expect a normalization of the historical correlation between the markets and the economic strength. But how and when?

A good place to begin is with an examination of the causes of the market’s dislocation from economic performance. In short, distortions caused by policy decisions, rather than economic fundamentals, drove more recent market behavior. This trend started back in 2008, with massive Federal Reserve (FED) assistance in the form of interest rate reductions and government bond buying, to provide liquidity and normalize the functioning of the market. In 2020, that level of stimulus was far surpassed with the US government sending checks to individuals , providing loans to businesses, (some gifted) and boosting unemployment compensation. These fiscal policies coupled with monetary policy which had the FED buying securities and corporate bonds in addition to the previously enacted government bond purchases and dropping interest rates drop to zero, served to prop up the equity market. Investment dollars must find a home that produces a “real” (after inflation) return and there are few places beyond equities, or other “risk assets” for most investor to find positive real returns.

With the equity markets set up for continuing support in early 2021 with another check distribution, an increase to unemployment benefits, and extension of delayed student loan repayments, etc., expectations are for the continuance of this bull cycle. However, at some point the music stops and so does the dance. When supportive policy ceases, the market will have to fend for itself and I fear we will face one of two possibilities: another dip (or crash) or an elongated “flattening of the curve”. The latter would mean very subdued equity market progress, a flattening of returns well below trend line returns, for an extended period to allow current equity market values to catch up with economic realities.

The crash or flattening alternative for realignment of the market and the economy is rather unpredictable. While most long-term capital market assumptions from leading investment research firms do not specify their alternative predicted, the end result which is expected returns averaged annually over the long-term investment horizon, remains the same: below trend returns for all major asset classes.

For example, Blackrock’s outlook on the market mirrors this outlook for bleak future returns. For example, US large cap equities are expected to perform at an average annualized return rate of 4.1% over the next five years, 5.0% annualized returns over the next 10 years and only a 6.3% per year over the next 20 years. Historically, these expected returns are well below the averages of the last 5, 10- and 20-year periods of 7.11%, 9.23%, 9.24% ,respectively1. To demonstrate the efficacy of the “reversion to mean” in the large cap US equity market, the 50-year annualized return is 9.41%which is due to the stability of asset class behaviors where large equity research departments can make quite accurate expected return estimations over long investment time horizons.

The performance outlook for US investment grade bonds, representing the bulk of a typical insurance company portfolio, is even more disappointing. The 5, 10 and 20-year returns are projected to be -0.1%, 0.8% and 2.0% respectively. Blackrock uses the Bloomberg Barclays US Aggregate Index, a common performance benchmark used by insurers, as a proxy for this segment of the overall US Bond market.

This is not just one firm’s pessimistic view. JP Morgan Asset Management’s expected return projections, based upon their Long Term Capital Market Assumptions, are substantially in line with expectations for significantly lower returns than historically earned for both stocks and bonds.

Clearly, we are in an anomalous time, one characterized by significant market distortions caused by the government’s fiscal policy and the FED’s monetary actions recently, and over the last 12 years. Insurers should make asset allocation adjustments based upon revised objectives and perhaps also revise their risk appetite when required to achieve their investment goals.

1 Source: https://dqydj.com/sp-500-historical-return-calculator

2 Facebook, Amazon, Apple, Netflix, Google and Microsoft